You’ve always been an analytical thinker. A problem solver. Maybe a math whiz, too.

There’s a career that matches your strengths. Certified Public Accountants—or CPAs—excel in these qualities.

Let’s explore why a CPA is no ordinary accountant and what it takes to become one.

Want to Be a CPA? Here’s What You Need to Know

General accountants handle many tax and financial duties. CPAs are qualified to do much more, including working with federal agencies and providing a greater range of services. But it takes additional time, education, and effort to become one.

What Accountants Do

How is a general accountant different from a CPA? First, accountants (and auditors) can provide services with just a bachelor’s degree. They often work for private companies, including accounting agencies, tax preparation services, finance and insurance companies, or government offices.

In these organizations and departments, you’ll find accountants:

- Reviewing financial records for accuracy, compliance, and efficiency.

- Managing taxes to ensure correct and timely payments.

- Identifying risks, improving systems, and suggesting ways to boost profits.

CPA vs. Accountant: What’s the Difference?

A CPA is an accountant with higher qualifications and more responsibilities. They’re able to provide expanded services, including:

- Running their own public accounting firms.

- Representing clients before the IRS.

- Filing reports with the Securities and Exchange Commission (SEC).

- Performing financial statement audits.

- Signing tax returns on behalf of clients.

Before starting their own firms, many CPAs work at public accounting firms.

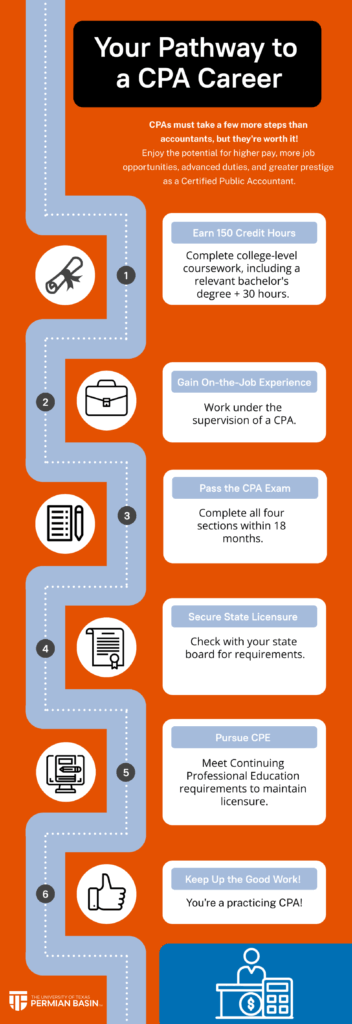

How Do You Become a CPA?

The more advanced your career, the more education and credentials you need. If you’re aiming to become a CPA, here’s what it takes:

- Completing 150 semester hours of college-level coursework.

- Gaining supervised work experience.

- Passing the national CPA exam.

- Securing state licensure.

- Maintaining licensure through continuing education.

- Following AICPA’s Code of Professional Conduct.

- Upholding a fiduciary responsibility for clients.

CPA Earnings and Job Prospects

Salary prospects for CPAs are bright: an average of about $91,000 per year. CPAs working through AICPA can earn even higher average annual salaries: about $99,000.

Want to know what CPAs in your area are making? Find out fast with this salary tool.

CPAs are also likely to enjoy more job opportunities. They can work internationally, in a wider range of fields, and in upper-level roles. Those extra qualifications count!

Frequently Asked Questions

This information can help you get started on your CPA journey:

- What do CPAs do that general accountants don’t?

CPAs are qualified to work at the federal level, representing clients before the IRS and filing reports with the Securities and Exchange Commission. While they have all the same abilities, their additional qualifications allow them to offer a broader range of services.

- How much more education is required for a general accountant to become a CPA?

Accountants must complete a related bachelor’s degree—the equivalent of 120 college-level credit hours. Aspiring CPAs must complete 150 semester hours, show hands-on work experience under a CPA, pass the CPA exam, obtain state licensure, and maintain licensure through continuing education courses.

- What are the career prospects for CPAs?

CPAs enjoy annual earnings in the $90,000+ range. With their additional qualifications, CPAs are also likely to have more job opportunities, including working in a broader range of industries, more advanced positions, and even internationally.

Online Degrees for Aspiring CPAs at All Levels

Ready to prepare for a career as a CPA? We’ve developed AACSB-accredited programs to help get you there.

Our online Master of Professional Accountancy program’s specialized curriculum:

- Prepares you to sit for the latest CPA exam.

- Enables you to complete the 150 hours you’ll need for licensure.

- Meets Texas state requirements.

Still on the fence about becoming a CPA?

Our online MBA in Accounting offers a helpful CPA track and broad, highly marketable business skills.

Just getting started?

Our online BBA in Accounting provides the foundation you need to succeed in related roles.

Get more information and apply here.

Other articles you may be interested in:

-

When you hear the word “accountant,” who comes to mind? Someone balancing spreadsheets and filing taxes? If so, you’re on the right track. But there’s more to it. Within the field of accounting, one credential stands apart: the Certified Public Accountant (CPA). While both accountants and CPAs manage finances, advise clients, and ensure the accuracy…

-

Picture this: You’re a junior accountant, and your manager asks you to tweak a report to make the numbers look better. The request sounds harmless enough—just a small tweak—but you know it’s not above board. Now you’re stuck. Do you follow orders and risk crossing an ethical line, or do you push back and risk…

-

It’s tax season. Your spreadsheets are a mess, your coffee’s cold, and it’s month-end close—again. Enter blockchain technology: a secure system that delivers real-time updates, lets you safely share data … and makes your job much easier in the process. Not exactly sure what blockchain is? Don’t worry! You’re in the right place. Let’s break…